godsquadgeek

Member

I have a little of everything in my portfolio, however, I do recommed something new. called cryptocurrency.

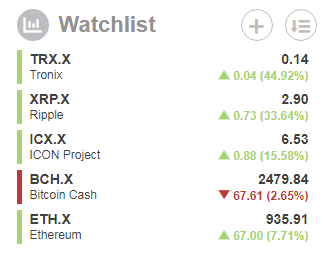

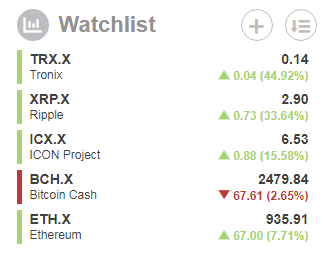

or crypto's. this is today's performance of these below tickers

in last fifteen minutes, TRX went up from 45% to 85%

as long as you have good networks to alert you when you are oversold, your in the money. I am plus 100% in last month.

right now, the above coins is what i am trading. best to hold a little in each.

not bitcoin cash and not ethereum. just to top three.

available on binance.com, if computer site crashes get the app on your phone. buy market when alot of buyers happening.

when finding ticker on binance, you have to find TRX, or XRP, or ICX. teh above tickers in the picture are the tickers you use to find on blog called stocktwits. a forum like this but about investing.

This is not investment advice, as I have lost a lot even on crypto's I advise contacting a professional if you are not able to risk the amount you wish to deposit. But nothing above should be taken as advice, since I am not a registered investment professional. I do have several friends who are becoming rich on crypto's I thought i would start a thread to see where it goes.

or crypto's. this is today's performance of these below tickers

in last fifteen minutes, TRX went up from 45% to 85%

as long as you have good networks to alert you when you are oversold, your in the money. I am plus 100% in last month.

right now, the above coins is what i am trading. best to hold a little in each.

not bitcoin cash and not ethereum. just to top three.

available on binance.com, if computer site crashes get the app on your phone. buy market when alot of buyers happening.

when finding ticker on binance, you have to find TRX, or XRP, or ICX. teh above tickers in the picture are the tickers you use to find on blog called stocktwits. a forum like this but about investing.

This is not investment advice, as I have lost a lot even on crypto's I advise contacting a professional if you are not able to risk the amount you wish to deposit. But nothing above should be taken as advice, since I am not a registered investment professional. I do have several friends who are becoming rich on crypto's I thought i would start a thread to see where it goes.

Last edited: