Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

Style variation

-

-

-

-

-

Desire to be a vessel of honor unto the Lord Jesus Christ?

Join Hidden in Him and For His Glory for discussions on how

https://christianforums.net/threads/become-a-vessel-of-honor-part-2.112306/

-

-

-

-

Focus on the Family

Strengthening families through biblical principles.

Focus on the Family addresses the use of biblical principles in parenting and marriage to strengthen the family.

Read daily articles from Focus on the Family in the Marriage and Parenting Resources forum.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The Tea Party

- Thread starter Lewis

- Start date

G

Gendou Ikari

Guest

Leave it to a socialist, brandishing a tattoo of a sickle on his chest to walk us through "Liberal Economics 101" and horrifically misrepresent the impact of supply. Please forget everything you were shown above, lest you begin to crave vodka and dream of vacations in Moscow.

Awww... I want to go to Moscow (Москва) so badly. I can probably speak enough Russian to find my way around.

Putting actual capitalist conditions into the equation, there is power to drive the economy by reducing taxes and government spending.

First is the classic Keynesian graph which depends on the theory that demand. You have your prices and your output. Interesting theory, but flawed. This is the one Red showed above (lower left)

The book I learned it from was written by Walter J. Wessels, who received his Ph.D from the Chicago School of Economics. There is not a more free-market based college in the country.

View attachment 1687

Here's what Red doesn't want to show you... Sorry, Red. This is gonna hurt.

View attachment 1688

What you have here is the real world where people will not stop or alter their demand for goods and services. It's a vertical demand line which is more accurate than Red's because, what would force consumers to demand less of a product or service just because the supply goes up? Won't they want the things they wanted before? That's voodoo socialist thinking! As supply increases demand stays constant for the most part. So the scare tactic of a recession is just that. A scare tactic.

Woah! I am thoroughly confused. You don't seem to understand the graph you posted. Firstly, the demand function is not vertical. It is negative and a curve. It is the blue-line in both graphs. Secondly, I never stated that consumers will demand less if the supply goes up. In fact, I said just the opposite. In my graph, on the bottom-left, the exact same thing happens as in your graph. It's simply that your supply function is vertical and mine is a curve. The same thing happens in both graphs: output increases and prices drop. Oh, no! Conservatives are secretly Communists! :p

Lastly, from looking at your graph, the supply function is vertical, because supply is vertical in the long-run. These are not conservative and socialist explanations, but merely short-term and long-term graphs. Not to sound cruel or anything, I just don't think you know how to read the graphs you are looking at.

How does this relate to lower tax rates? Lowering marginal income tax rates will motivate people to work more. Wouldn't you work more, if you were taking home more? Not Red, but you! Lowering capital gains taxes work similarly in that they influence investors to employ their resources more robustly.

This is one of those things that sounds good, but hasn't been proven. I could equally argue that higher taxes motivates people to work harder, since they need to work harder to maintain the same standard of living, they once did. :yes

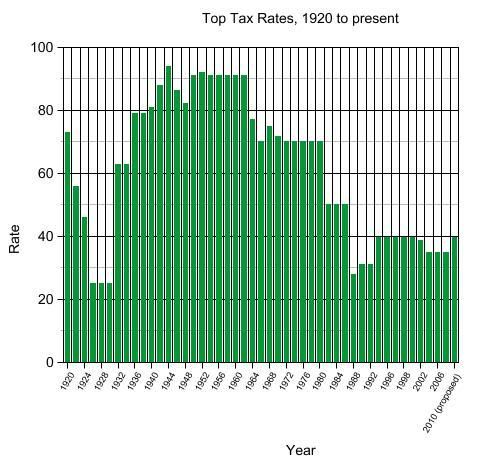

I always thought the older generations were hard working. Now I know they must have been lazy as hell with those kinds of tax rates.

Decrease taxes --> more motivation to work --> more productivity --> higher revenue tax base due to increase in production

If President Regan was such a supply-side believer, why did he have to raise taxes on the Middle-Class? And if supply-side economics works, why didn't we experience impressive growth under President Bush in 2001-2009?

Combine this with decreased government spending, and you have a utopia that socialists can only dream of; or make up while they're picking away at capitalism.

It's a shame Americans don't know about the Social Democratic movement in Europe, or never had one themselves. Modern socialists are quite pragmatic, and non-utopian.

Red? I mean Gendou? I'm just kidding with you. No insults implied, though I tend to believe you'd be very happy with the nick-name.[/B]

It's cool. I love it when friends jest and poke fun at each other. I can live with the nickname. Especially since one of my favourite songs is the Red Flag. Just ignore the video. Vladimir Lenin is a traitor to the socialist movement. :p

G

Gendou Ikari

Guest

I'll say what I've said via PM's. I have come to have regard Gendou. I don't want anyone else to read any venom in my previous post. All "tongue in cheek".

(except the main point about supply-side economics) :D

Awww... I feel the same. :adore

Mike

Member

- Mar 13, 2010

- 15,286

- 1,475

Not to sound cruel or anything, I just don't think you know how to read the graphs you are looking at.

Oh boy... apparently not at 1:30 in the morning.

Yeah, I don't do hotels very well. I did mislabel the lines, but this does serve to demonstrate that if you shift the vertical supply line and increase supply, demand will not decrease proportionally. Prices will decrease.

Yeah, I don't do hotels very well. I did mislabel the lines, but this does serve to demonstrate that if you shift the vertical supply line and increase supply, demand will not decrease proportionally. Prices will decrease.This is one of those things that sounds good, but hasn't been proven. I could equally argue that higher taxes motivates people to work harder, since they need to work harder to maintain the same standard of living, they once did. :yes

You could argue that, but you'd be wrong. Society will see a greater response when it's workers see more reward for their work. The further along the continuum to socialism, the less reward realized, the less motivation people personally see to work, the less they'll work. Having it to your extreme where we throw it all in the pot and spread the wealth entirely, there will be zero motivation for industrious entrepreneurs and labors overall. You can't possibly be arguing that less personal prosperity will stimulate the economy, can you? Well, I suppose you are, but logic doesn't follow.

If President Regan was such a supply-side believer, why did he have to raise taxes on the Middle-Class? And if supply-side economics works, why didn't we experience impressive growth under President Bush in 2001-2009?

Reagan was promised major spending cuts, which the liberal congress never delivered. W was not fiscally conservative. While he cut taxes, he was an over-spender. :bigfrown

It's cool. I love it when friends jest and poke fun at each other. I can live with the nickname. Especially since one of my favourite songs is the Red Flag. Just ignore the video. Vladimir Lenin is a traitor to the socialist movement. :p

Well then, "Red" it is. It has the added benefit of being easier to pronounce too!

jasoncran

Member

- May 17, 2009

- 38,271

- 185

gendou, you called the free market evil. that to me says socialist. is that correct? i know that socialism need not be totalarianism.

i am sorry, if i was taxed more i would work more spend less. as i would have to do that to make it.If i make more on the paper route i must take into account that my wifes ss check will be taxed. for if i dont i will have to pay each year with interest.

i can do that, but if the rate were to go up. it would put a hurtin on me.

i am sorry, if i was taxed more i would work more spend less. as i would have to do that to make it.If i make more on the paper route i must take into account that my wifes ss check will be taxed. for if i dont i will have to pay each year with interest.

i can do that, but if the rate were to go up. it would put a hurtin on me.

G

Gendou Ikari

Guest

Oh boy... apparently not at 1:30 in the morning.Yeah, I don't do hotels very well. I did mislabel the lines, but this does serve to demonstrate that if you shift the vertical supply line and increase supply, demand will not decrease proportionally. Prices will decrease.

I think I understand what you are saying now. However, I find that conclusion somewhat silly. I am going to talk to one of the economics professors at my University, but it seems like the graph you presented is argueing that businesses are instantly able to adjust to vicissitude in the market. The neoclassical (free-market, conservative) model doesn't even argue that; it is presented below, and is identical to the one I posted above. Can you give me a link where you read this, so I can try to understand what the arguement behind your model is?

You could argue that, but you'd be wrong. Society will see a greater response when it's workers see more reward for their work. The further along the continuum to socialism, the less reward realized, the less motivation people personally see to work, the less they'll work. Having it to your extreme where we throw it all in the pot and spread the wealth entirely, there will be zero motivation for industrious entrepreneurs and labors overall. You can't possibly be arguing that less personal prosperity will stimulate the economy, can you? Well, I suppose you are, but logic doesn't follow.

You misunderstand me. I do not want to abolish capitalism. It is wonderful. I merely think it is foolish to place market fundamentalism ahead of political and social duties. Capitalism needs to be moulded and tempered, not done away with.

Reagan was promised major spending cuts, which the liberal congress never delivered. W was not fiscally conservative. While he cut taxes, he was an over-spender. :bigfrown

Nonetheless, he chose to raise taxes on the middle-class, while maintaining his tax cuts for the wealthy.

Well then, "Red" it is. It has the added benefit of being easier to pronounce too!

It is gehn-doh ee-kah-ree. :nod

jasoncran

Member

- May 17, 2009

- 38,271

- 185

mike doesnt speak japanese.

that is how i would pronouce it if i was girl!

the i would be silent in that last name. men dont pronounce vowels at the end of words once the relationship is established.

and in some cases never.

case in point

men would pronounce number one as the ich(eech) and a woman as ichi(eechi).

that is how i would pronouce it if i was girl!

the i would be silent in that last name. men dont pronounce vowels at the end of words once the relationship is established.

and in some cases never.

case in point

men would pronounce number one as the ich(eech) and a woman as ichi(eechi).

G

Gendou Ikari

Guest

gendou, you called the free market evil. that to me says socialist. is that correct? i know that socialism need not be totalarianism.

I am a democratic socialist or a social democrat, depending on if you are British/Australian or American.

i am sorry, if i was taxed more i would work more spend less. as i would have to do that to make it.If i make more on the paper route i must take into account that my wifes ss check will be taxed. for if i dont i will have to pay each year with interest.

What if you worked enough extra hours to maintain your same income? Would you spend less?

i can do that, but if the rate were to go up. it would put a hurtin on me.

Socialists like myself would not want to raise taxes on those who are at your income level.

jasoncran

Member

- May 17, 2009

- 38,271

- 185

nope, if i work more on the paper route i would make more but i would get taxed more so i must pay.

keep in mind that i have made up to 15k a year and after deductions. i had to pay about three grand in taxes.

i must match these things myself

medicare, ss, and also the 15% taxes.

so any rate increase will hit me when i work harder! so yes i can work harder and make more and pay more. i'm not far from the 60k threshold where that will hurt me a lot more

i dont need things that i cant buy with cash,that being said, i want to be debt free. and that is why i do that in part.

second, i have what i need for the moment. my trucks runs, the house is in need of painting. but that is minor.

and i dont need to much furniture. why spend when you dont need things.

and i work the same hours now and make less. so i have to spend less. and i have been slowly cutting back on some things.

i have about 400 dollars of leeway at present that i can afford to not to need, but i dont want to go there. i have plans to pay off my house in less then twenty yrs from the origin of the mortage, and so far i have paid two yrs ahead two the principal.

keep in mind that if you tax the wealthy , i will get hit since my customers are the wealthy. and i have lost some to that already( the economy) and also tips have dropped.

keep in mind that i have made up to 15k a year and after deductions. i had to pay about three grand in taxes.

i must match these things myself

medicare, ss, and also the 15% taxes.

so any rate increase will hit me when i work harder! so yes i can work harder and make more and pay more. i'm not far from the 60k threshold where that will hurt me a lot more

i dont need things that i cant buy with cash,that being said, i want to be debt free. and that is why i do that in part.

second, i have what i need for the moment. my trucks runs, the house is in need of painting. but that is minor.

and i dont need to much furniture. why spend when you dont need things.

and i work the same hours now and make less. so i have to spend less. and i have been slowly cutting back on some things.

i have about 400 dollars of leeway at present that i can afford to not to need, but i dont want to go there. i have plans to pay off my house in less then twenty yrs from the origin of the mortage, and so far i have paid two yrs ahead two the principal.

keep in mind that if you tax the wealthy , i will get hit since my customers are the wealthy. and i have lost some to that already( the economy) and also tips have dropped.

G

Gendou Ikari

Guest

keep in mind that i have made up to 15k a year and after deductions. i had to pay about three grand in taxes.

i must match these things myself

medicare, ss, and also the 15% taxes.

Now, wouldn't you agree it is silly for those who make income over 100,600 USD, not to have to pay income tax over that 100,600 USD?

jasoncran

Member

- May 17, 2009

- 38,271

- 185

i am not saying that the rich shouldnt pay taxes, but even here in my state that's not a lot.

if i made that i wouldnt be in the same house, but i wouldnt buy a lot of stuff.I have learned slowly not to lust after things anymore.

i have a question for you. why should pay more taxes and get less from the govt as in reality you cant track where your money goes.

the budgets are shell games. this one is low take from the one that has surplus and make it look like we dont have enough.

in order to middle class here, that takes about 60k a year.

if i made that i wouldnt be in the same house, but i wouldnt buy a lot of stuff.I have learned slowly not to lust after things anymore.

i have a question for you. why should pay more taxes and get less from the govt as in reality you cant track where your money goes.

the budgets are shell games. this one is low take from the one that has surplus and make it look like we dont have enough.

in order to middle class here, that takes about 60k a year.

Mike

Member

- Mar 13, 2010

- 15,286

- 1,475

Can you give me a link where you read this, so I can try to understand what the arguement behind your model is?

Capitalism needs to be moulded and tempered, not done away with.

I just did a google search for images. As with many of the differences throughout this board, this is one of those things that have been argued for a long time. I don't expect that we'll come to agree here. Both of the economic theories have their flaws; I'll admit that much. But, I don't believe the obstacles of supply-side economics dismiss it as the more legitimate approach.

What if you worked enough extra hours to maintain your same income? Would you spend less?

This is what I find "silly". You're wanting to force Americans to pay higher taxes and work more. (not logical) It's always been acknowledged that we work more hours, have less vacation and are more productive than the rest of the industrialized world! We get and average of 2 weeks vacation, while other countries get 3, 4, 5 or more weeks/year!

Productivity and Vacation Comparisons by Country - Business Productivity - Entrepreneurial Tips – Resources for Entrepreneurs - Gaebler Ventures - Chicago, Illinois

Now, wouldn't you agree it is silly for those who make income over 100,600 USD, not to have to pay income tax over that 100,600 USD?

I believe it was Winston Churchill who said, (and I paraphrase) "If you're 18 and not a liberal, you have no heart. If you're 28 and not a conservative, you have no brain."

It's easy to convince idealistic youth of liberal ideology, because they often haven't needed to manage micro-economics of a household. I'd love to have this same conversation with you in 10-15 years.

It's easy to convince idealistic youth of liberal ideology, because they often haven't needed to manage micro-economics of a household. I'd love to have this same conversation with you in 10-15 years.What is the point of over-taxing wealthy people? They are the ones purchasing at a higher rate and feeding the system. To place a disproportional burden on them an penalize them for their industrious pursuits is unfair AND it puts a strain on an already tax-heavy system. Envy and resent toward them for their success is usually the motivation this agenda. :gah

jasoncran

Member

- May 17, 2009

- 38,271

- 185

gendou, just so you know, i work seven days a week at the paper route. so why would i want to work more harder to get the same money?

when less taxes will give me more money in the pocket and possibly more time off.

then theres this. the failing of your view is this. greed.

greed permeates both parties.

if you doubt then tell me why each yr no matter what congress gets a raise. what happen to serve cause the country needs your talents, not the other way around.?

when less taxes will give me more money in the pocket and possibly more time off.

then theres this. the failing of your view is this. greed.

greed permeates both parties.

if you doubt then tell me why each yr no matter what congress gets a raise. what happen to serve cause the country needs your talents, not the other way around.?

G

Gendou Ikari

Guest

I just did a google search for images. As with many of the differences throughout this board, this is one of those things that have been argued for a long time. I don't expect that we'll come to agree here. Both of the economic theories have their flaws; I'll admit that much. But, I don't believe the obstacles of supply-side economics dismiss it as the more legitimate approach.

I found a supply-side article and went over some of its tenants with a Econ. Prof. I just find it absolutely absurd to claim that more demand in the economy will not lead to greater production on the supply end. Besides, supply-side has been totally discredited by the fact that tax revenues did not increase like they had claimed it would. I was so surprised and shocked when my brother told me there was a supply-side economist on Fox News, the other day. I didn't know they existed any more.

This is what I find "silly". You're wanting to force Americans to pay higher taxes and work more. (not logical) It's always been acknowledged that we work more hours, have less vacation and are more productive than the rest of the industrialized world! We get and average of 2 weeks vacation, while other countries get 3, 4, 5 or more weeks/year!

Productivity and Vacation Comparisons by Country - Business Productivity - Entrepreneurial Tips – Resources for Entrepreneurs - Gaebler Ventures - Chicago, Illinois

I do not want ordinary Americans to work more or be taxed more. I simply want the rich to pay more in taxes. And, the French are more productive per work hour than we are. On average the productivity of a French worker is 56.6 USD compared with 49.6 USD for American workers. They may take more vacation time, but that is a cultural meme. They are not working less because of the evil 40 per cent top marginal tax rate.

I believe it was Winston Churchill who said, (and I paraphrase) "If you're 18 and not a liberal, you have no heart. If you're 28 and not a conservative, you have no brain."It's easy to convince idealistic youth of liberal ideology, because they often haven't needed to manage micro-economics of a household. I'd love to have this same conversation with you in 10-15 years.

So you are basically argueing that there are no liberal old people? Once again, managing a country is not the same as managing a household. Comparing the idea of the laissez-faire economic system to a balanced household budget holds no water. It is not an analogous comparison. It just sounds good. And I am not a liberal, I am a social democrat. I staunchly reject the liberal tradition, but the laissez-faire economic system is a liberal idea. Ronald Regan was a conservative liberal.

What is the point of over-taxing wealthy people? They are the ones purchasing at a higher rate and feeding the system. To place a disproportional burden on them an penalize them for their industrious pursuits is unfair AND it puts a strain on an already tax-heavy system. Envy and resent toward them for their success is usually the motivation this agenda. :gah[/B]

I am not envious or resentful. I live in a middle-class family and I am getting all of my college tuition paid for by my parents. Also, I would much rather have the money distributed to a bunch of middle-class, working class people, so aggregate demand can rise in the economy, which will lead to the creation of more jobs. Lower-income people spend more, because they cannot afford to save more. Rich people, on the other hand, invest a majority of their money and which leads to bubbles. :p

I don't know about you, but I am not comfortable with the fact that the lower 80 per cent of Americans only hold 15 per cent of the wealth.

jasoncran

Member

- May 17, 2009

- 38,271

- 185

gendou, let me say this.

ever work for the govt? ever see the waste? i have on all levels

case in point

budgeting? if the govt doenst spend it loses the money. if its budget a thousand dollars for a particle thing, and uses half of that the budget will be reduced. so they spend whole amoun whether they need it or not.

use say that the rich, should be taxed.

fine then. are you going to stay poor an not try to make the most you can so that you dont have to be taxed like they will be or are you going to work harder for less.

$106,100 .seems like alot of money to you if you are single.but when you are married or own business tis not much.

if you own a garage it will take that just to get started if dont own the tools.for instance some lifts cost 5k each, the brake lathes the same, tire machines and then theirs the tanks. so you have to borrow that.

and then theres the insurance and bonding. you have to make enough for you to live and rent the building you are in. and what if you want to hire a person and pay them. 30k a person or more and you have to pay their ss,medicare, and irs taxes.

so then again 100k aint much.you only make part of what pay to the irs back when you deduct.

ever work for the govt? ever see the waste? i have on all levels

case in point

budgeting? if the govt doenst spend it loses the money. if its budget a thousand dollars for a particle thing, and uses half of that the budget will be reduced. so they spend whole amoun whether they need it or not.

use say that the rich, should be taxed.

fine then. are you going to stay poor an not try to make the most you can so that you dont have to be taxed like they will be or are you going to work harder for less.

$106,100 .seems like alot of money to you if you are single.but when you are married or own business tis not much.

if you own a garage it will take that just to get started if dont own the tools.for instance some lifts cost 5k each, the brake lathes the same, tire machines and then theirs the tanks. so you have to borrow that.

and then theres the insurance and bonding. you have to make enough for you to live and rent the building you are in. and what if you want to hire a person and pay them. 30k a person or more and you have to pay their ss,medicare, and irs taxes.

so then again 100k aint much.you only make part of what pay to the irs back when you deduct.

jasoncran

Member

- May 17, 2009

- 38,271

- 185

must be nice. i worked my way into college and made money while i was at it. the gi bill paid me to go school and i could keep the difference.

on your french labor thing

Lump of labour fallacy - Wikipedia, the free encyclopedia

hmm if my family in france would oblidge i would ask them but they dont talk politics alot. i cant blame them.

on your french labor thing

Lump of labour fallacy - Wikipedia, the free encyclopedia

hmm if my family in france would oblidge i would ask them but they dont talk politics alot. i cant blame them.

G

Gendou Ikari

Guest

gendou, let me say this.

ever work for the govt? ever see the waste? i have on all levels

case in point

budgeting? if the govt doenst spend it loses the money. if its budget a thousand dollars for a particle thing, and uses half of that the budget will be reduced. so they spend whole amoun whether they need it or not.

And the private sector doesn't have waste. I have seen nothing but waste and inefficiency in ever single job my Dad has worked at. Success is based more upon connections and nepotism than any sort of merit or efficiency.

use say that the rich, should be taxed.

fine then. are you going to stay poor an not try to make the most you can so that you dont have to be taxed like they will be or are you going to work harder for less.

I do not buy the arguement that the rich are harder working than the poor. I know many, many lazy rich people. I also don't buy the arguement that if you work hard, you can make it in America. We have less social mobility than most western countries.

$106,100 .seems like alot of money to you if you are single.but when you are married or own business tis not much.

Why should the income you make over 100,600 USD be taxed for benefit of the community? It is a regressive tax policy, since rich people do not need social security.

jasoncran

Member

- May 17, 2009

- 38,271

- 185

of course theirs waste but with the business world you can change it far easier then the govt will ever change.

so this amount of waste that you say we should support is ok with you(billions in the defense department, and also the irs that doesnt collect.)

or the millions at the local level that i see or hear of.

what is your major? you dont have any bills, try sending kid to college if you had to make that 106,100 and and had a wife who worked and with your income it totaled that. it wouldnt happend that easily.

dude, i was poor, what i got didnt come by the govt save the gi bill and that i paid for. and served in the guard for the rest. therefore nothing i got i was given.

i used to think that 30k was a ton of money,it aint.

my house payment is 1500 a month. and i can afford that. 1500 x 12 = 1800 a month. that does inclued the the p & I and and escrow. i havent added the other expenses.

even 60k isnt alot to me. its just not. you think 100k is alot because you are single and have no expenses. when you have a wife, kids, medical expenses, and then its not a lot at all.

in business waste cost and can cause a business to go under(ECONOMIC CRISIS), and with the govt nothing of the sort happens. it gets cut but not done in , if cut at all.

case in point gm motors. they rented buildings and didnt use them and went under and we taxpayers now foot the bill.

interesting when you learn that. it wasnt the union that did that to them but that waste. they could afford the union bills even that is now hurting them.

so this amount of waste that you say we should support is ok with you(billions in the defense department, and also the irs that doesnt collect.)

or the millions at the local level that i see or hear of.

what is your major? you dont have any bills, try sending kid to college if you had to make that 106,100 and and had a wife who worked and with your income it totaled that. it wouldnt happend that easily.

dude, i was poor, what i got didnt come by the govt save the gi bill and that i paid for. and served in the guard for the rest. therefore nothing i got i was given.

i used to think that 30k was a ton of money,it aint.

my house payment is 1500 a month. and i can afford that. 1500 x 12 = 1800 a month. that does inclued the the p & I and and escrow. i havent added the other expenses.

even 60k isnt alot to me. its just not. you think 100k is alot because you are single and have no expenses. when you have a wife, kids, medical expenses, and then its not a lot at all.

in business waste cost and can cause a business to go under(ECONOMIC CRISIS), and with the govt nothing of the sort happens. it gets cut but not done in , if cut at all.

case in point gm motors. they rented buildings and didnt use them and went under and we taxpayers now foot the bill.

interesting when you learn that. it wasnt the union that did that to them but that waste. they could afford the union bills even that is now hurting them.

G

Gendou Ikari

Guest

of course theirs waste but with the business world you can change it far easier then the govt will ever change.

so this amount of waste that you say we should support is ok with you(billions in the defense department, and also the irs that doesnt collect.)

or the millions at the local level that i see or hear of.

Waste is never good, but it is an acceptable by-product. Much better than creating a limited form of government. Besides, the private sector created the 2008 economic collapse. How is that efficient?

what is your major? you dont have any bills, try sending kid to college if you had to make that 106,100 and and had a wife who worked and with your income it totaled that. it wouldnt happend that easily.

If I had my way, college wouldn't break the bank for any families. In France, it only costs about 5,000 USD, maximum, for a masters education. That is half the price a semester costs my parents in the United States. Then again, France has a system where the wealthy support the poor.

dude, i was poor, what i got didnt come by the govt save the gi bill and that i paid for. and served in the guard for the rest. therefore nothing i got i was given.

The government doesn't have to make transfer payments to alleviate the burdens of poor people. Think about how much better it would be if health care was free, like it is in the UK. Nobody goes broke in other western countries because of medical bills.

jasoncran

Member

- May 17, 2009

- 38,271

- 185

uh, not so fast, i dont want govt run healthcare

been there already, if we cant keep the promises to me a vet and my fellow vets how can we run the entire system?

and would you want ot wait yrs for the simple surgeries ie hip, shoulder that are non life threatening?

drew has told me that it takes a two yr wait for those in canada to get a shoulder rotator cuff fixed. so then if i did that then the govt would also have to pay me for lost wages not mention wean me off the opiods. when even now i would get the surgery done if needed in a quarter of that time.

and it was the Govt telling the banks to make loans to those who cant afford them in part that cause this mess. the banks were forced into that as they knew what would happen.

strange that even now bernie mae and freddie mac arent being reformed.

this was a long time coming. if the soviets were so good at runing things why then did we have to send them grain?

surely those socialists knew how to run things over there

my comrade dont argue with me over govt effeiciency i have more insider knowledge then you think.

so it wasnt the guy who made 20k a yr and wanted a 400000 usd house fault for buying a home? or the guy who kept refying hoping the market would go up..

were these totally inocent

and i bought my house in 2007 when it was high, and i planned for the payments to go as high as i pay now. i reasarched what i was doing. and sought advise from co-workers and my accountant.

of course it was the banks in part along with govt, and the idiots that thought that they could afford a mansion on paupers pay.

been there already, if we cant keep the promises to me a vet and my fellow vets how can we run the entire system?

and would you want ot wait yrs for the simple surgeries ie hip, shoulder that are non life threatening?

drew has told me that it takes a two yr wait for those in canada to get a shoulder rotator cuff fixed. so then if i did that then the govt would also have to pay me for lost wages not mention wean me off the opiods. when even now i would get the surgery done if needed in a quarter of that time.

and it was the Govt telling the banks to make loans to those who cant afford them in part that cause this mess. the banks were forced into that as they knew what would happen.

strange that even now bernie mae and freddie mac arent being reformed.

this was a long time coming. if the soviets were so good at runing things why then did we have to send them grain?

surely those socialists knew how to run things over there

my comrade dont argue with me over govt effeiciency i have more insider knowledge then you think.

so it wasnt the guy who made 20k a yr and wanted a 400000 usd house fault for buying a home? or the guy who kept refying hoping the market would go up..

were these totally inocent

and i bought my house in 2007 when it was high, and i planned for the payments to go as high as i pay now. i reasarched what i was doing. and sought advise from co-workers and my accountant.

of course it was the banks in part along with govt, and the idiots that thought that they could afford a mansion on paupers pay.